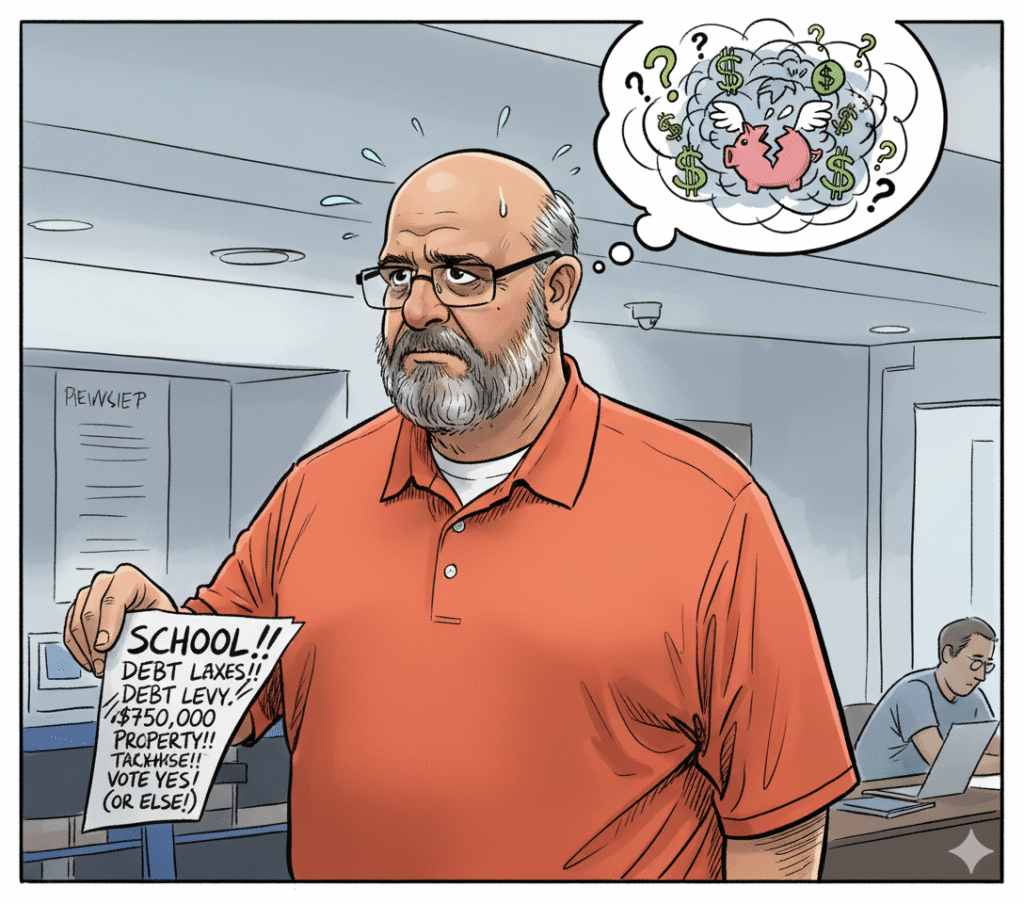

For homeowners in the Clinton School District — especially seniors and those on fixed incomes — what seemed like a routine tax hearing has turned into a financial ambush.

Despite constitutional protections under Missouri’s Hancock Amendment, which is meant to shield taxpayers from sudden increases triggered by reassessments, Clinton residents are now staring down an 11% property tax hike. Why? Because the Clinton School Board found a workaround — and used it.

The Setup: A Promise of Protection Undone

Earlier this year, property assessments across the district increased by 11%. Under the Hancock Amendment, that should have automatically triggered a rollback in the school district’s tax levies — ensuring the rise in home values wouldn’t mean a bigger tax bill for property owners.

And at first, that’s exactly what happened. The operating levy was reduced in accordance with the law.

But in a move that has sparked outrage from the community and scrutiny from the Missouri legislature, the Clinton School Board simultaneously raised the district’s debt service levy by nearly the exact same amount — effectively nullifying the rollback and leaving taxpayers holding the bag.

“It’s going to be an 11% tax increase on everybody in that district,” said Rep. Reedy, speaking to the Special Interim Committee on Property Tax Reform on August 27. “That assessor put out, ‘Hey, I’m raising your values, but the levy should roll back,’ and the district turns right around and raises that debt service amount — the exact amount.”

– Rep. Reedy, August 27 hearing

The Meeting: A Packed House and a Painful Reality

At the August 25th school board hearing, which was livestreamed by Act for Missouri, a packed crowd of concerned residents gathered to voice frustration and disbelief. Emotions ran high as homeowners tried to understand why, despite the promised rollback, their tax bills were going up.

Superintendent Dan Brungardt, who proposed the levy adjustment, defended the decision by citing prior shortfalls in debt payments. He argued that the district needed a stronger reserve to avoid another year of dipping into funds to cover bond obligations.

“If you need someone to blame, I’m your guy,” Brungardt said. “I own that recommendation.”

But many weren’t buying it — especially those already struggling with high inflation, fixed incomes, or trying to keep roofs over the heads of renters.

A Costly Reality for the Most Vulnerable

Among those hit hardest are retirees, veterans, and low-income landlords who say this tax hike could mean the difference between making it to the end of the month or not. One disabled veteran who spoke at the meeting said plainly, “I don’t have kids in school, but I pay well over half my taxes to the district. And I can’t afford this.”

Landlords also warned of trickle-down consequences, with rising property taxes leading to higher rent for working families in Clinton.

Meanwhile, County Assessor Scott Largent made it clear he wasn’t the villain in this story. He explained that while he followed the law in increasing assessments, the Hancock rollback should have protected taxpayers — and would have, if the school board hadn’t reversed course with the debt service levy.

“Even without raising the debt service levy, they would have brought in $210,000 more this year than last. But they rolled it forward — perfectly mirroring the rollback — and claimed the total levy stayed the same. That’s the trick,” Largent said.

– Clinton School Board Meeting, August 25

Inefficiency Questions Emerge

Adding fuel to the fire, Act for Missouri raised questions about the district’s fiscal responsibility by highlighting that Clinton School District spends roughly $12,000 per student per year, while private schools in the area educate students for closer to $6,000.

“If private schools can deliver better education at half the cost — and still turn a profit — how can the public system justify a tax hike like this?”

– Act for Missouri, August 25

It’s a fair question — and one that resonates with a growing number of Missourians demanding accountability, not just more funding.

A Legal Loophole, But Is It Right?

Technically, the school board acted within the bounds of state law. Debt service levies are exempt from the Hancock rollback requirement, giving local boards discretion to raise them even when assessments skyrocket.

But as Rep. Reedy noted, legal doesn’t mean ethical. And when the result is an 11% effective tax increase, residents feel misled and under siege.

“We need to address it as a committee,” said Reedy. “To keep these kinds of things from happening.”

The Bottom Line for Clinton Homeowners

For many Clinton homeowners, the fallout is simple but severe: higher property tax bills, regardless of what the levy numbers say on paper. The rollback that should have shielded them has been canceled out by a quiet administrative maneuver, buried in budget documents and passed at a sparsely publicized hearing.

And the burden isn’t theoretical — it’s real money, with some homeowners estimating $500 to $600 more in taxes this year alone.

With the Missouri legislature now paying close attention, Clinton’s “Great Levy Swap” may become a blueprint for what not to do — or worse, a model that other districts follow unless the law is changed.