Missouri Legislature’s Special Session: A Controversial Push for Chiefs and Royals Stadium Funding

SB3 primarily designed to provide economic incentives for new stadiums for the Kansas City Chiefs and Royals, has ignited controversy due to its rushed legislative process, questionable economic merits, potential constitutional violations, and apparent dismissal of public opposition.

Why Governor Kehoe’s Sports Stadium Plan Is Bad for Missouri—and Why We Must Oppose SB3

Missouri taxpayers are once again being asked to foot the bill for billionaire sports team owners. Governor Mike Kehoe has called an extraordinary session to push through Senate Bill 3 (SB3), a proposal that would funnel millions in public money to build and renovate professional sports stadiums in Kansas City.

SB3

Senate Bill 3 (SB3) is a bill that provides significant tax credits and funding for sporting events

and professional sports facilities in Missouri. While it includes a provision for disaster relief,

there are serious concerns about its financial impact and constitutionality

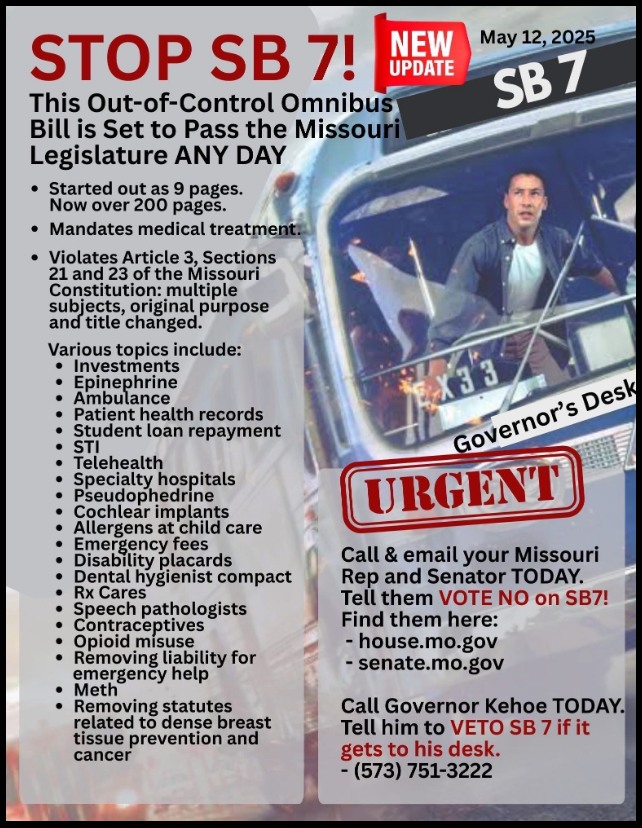

Oppose SB7: A Dangerous, Unconstitutional Omnibus Bill That Threatens the Freedom and Liberties of Missourians on Multiple Fronts

SB7 is unconstitutional—cramming laws into one bill breaks Missouri’s single-subject rule. The Supreme Court agrees. Urge our Lawmakers to VOTE NO!

Oppose SB7

SB7 is unconstitutional—cramming laws into one bill breaks Missouri’s single-subject rule. The Supreme Court agrees. Urge our lawmakers to VOTE NO!

Call to Action: Support SJR40 – Protect Constitutional Sheriffs in Missouri!

Support SJR 40 to protect MO sheriffs! Testify by 11 PM at witness.house.mo.gov. Call Speaker Patterson (573-751-0902). Act now for liberty! #ACT4MO

SJR40

SB133

SB152

SB485: A Step Towards Higher Voter Participation in School Board Elections

ACT4MO supports SB485 to move school board elections to November, but warns it doesn’t ensure conservative wins. Citizen action is vital for local governance.