Missouri families are being squeezed by soaring property assessments and top-down pressure from an unelected State Tax Commission (STC). Local assessors—who answer to voters—are being pushed to hit a 90–110% of market value “ratio,” often through Memorandums of Understanding (MOUs) that lock counties into blanket year-over-year hikes. The result? Higher tax bills based on paper gains homeowners haven’t realized and may never see in their bank accounts.

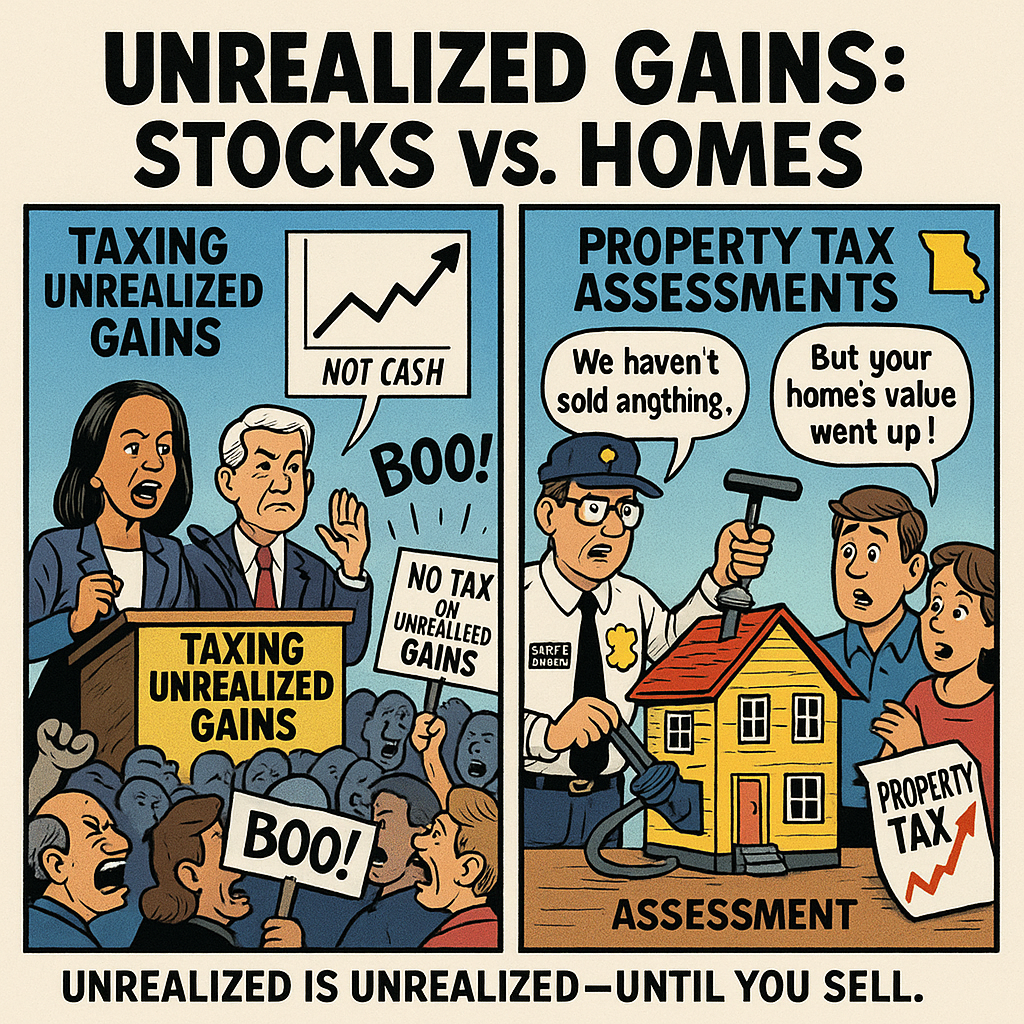

If Missourians bristled when national politicians floated taxing “unrealized gains” on stocks, we should feel the same when our homes are treated like tradable assets. Until you sell—or cash out with a new mortgage—those increases aren’t income. They’re numbers on paper.

No one should lose their home because they can’t afford their property taxes.

What’s happening now

- Unelected pressure on elected officials. The State Tax Commission can strong-arm counties that don’t hit a targeted ratio, pushing MOUs that force broad percentage increases—even where values are clearly outpacing income.

- Assessment spikes function like back-door tax hikes. Even if levies stand still, sudden reassessment windfalls raise bills—especially for seniors on fixed incomes and young families stretched by mortgages, insurance, and groceries.

- Due-process problems. Ordinary taxpayers struggle to navigate notices, comps, studies, and appeals—while decisions get made at a distance.

Want to see where counties stand? Check our live tracker of which counties have been pushed to sign MOUs:

👉 https://act4mo.info/countymou.html

This treats homeowners like day-traders

When Washington progressives proposed taxing unrealized gains, people erupted—because it violates a basic fairness principle: income is realized when you sell or cash out. Yet the same logic is being applied to Missourians’ homes. Your family doesn’t get to spend a Zillow estimate. You pay your mortgage, you maintain your home, and you stay put. Taxing paper appreciation punishes stability and penalizes the very people who keep communities strong.

What a Special Session should do (simple, fair, protective)

- Adopt acquisition-value assessment for owner-occupied homes.

Lock taxable value to the purchase price; reassess only at sale/transfer or when the owner takes a cash-out mortgage that establishes a higher value. Normal maintenance should not trigger reassessment. - Stop forced blanket hikes via STC directives or MOUs.

End top-down mandates for across-the-board increases. Require transparent legislative oversight for any statewide assessment directives. - Protect homes now.

Pause tax-sale foreclosures of owner-occupied homes while reforms pass, and provide a clear, affordable path to redeem property. - Guarantee due process and plain-language transparency.

Strengthen notice, evidence, and appeal rights. Require the publication of understandable county-level ratio studies and establish a real taxpayer ombudsman. - Truth-in-Taxation.

Prevent reassessment windfalls from becoming back-door tax hikes. When revenues rise faster than new construction, taxpayers—not bureaucracies—should have the final say.

What you can do in 60 seconds

We’ve made it easy to ask Governor Kehoe to call a Special Session on property-tax relief. Read the statement, add your name/city/ZIP, and send it from your own email—we collect nothing.

👉 Take Action Now: https://act4mo.info/ss-for-property-tax-reform.html

Share that link with friends, church groups, senior communities, and neighborhood associations. Every note matters—especially from homeowners who’ve felt the squeeze.

Common pushbacks (and how to answer)

“But market value went up—shouldn’t taxes?”

Rising estimates aren’t income. We tax realized gains and actual transactions, not paper values. Acquisition-value preserves stability while still taxing fairly at sale.

“Counties need revenue for services.”

Truth-in-taxation protects services while keeping increases honest and transparent. If government needs more, make the case to voters—don’t back-door hikes through reassessment spikes.

“This helps the wealthy.”

The hardest hit are seniors on fixed incomes, working families, and first-time buyers—people who can’t absorb sudden, forced hikes on unrealized gains.

Track county pressure and stay engaged

- County MOU Tracker: See what your county is facing!

👉 https://act4mo.info/countymou.html - 60-Second Letter to the Governor: Add your name and send.

👉 https://act4mo.info/ss-for-property-tax-reform.html

Sample messages you can use

Text a friend:

“Hey—property taxes are spiking on paper home values. That’s like taxing unrealized gains. Tell Gov. Kehoe to call a Special Session for real relief: https://act4mo.info/ss-for-property-tax-reform.html”

Email/Social caption:

“Home should mean security, not anxiety about the next reassessment. Tell Gov. Kehoe: call a Special Session for property-tax relief. 60-second email action: https://act4mo.info/ss-for-property-tax-reform.html

Bottom line

Missourians believe in stewardship, accountability, and the dignity of home. Let’s protect homeowners from taxation on unrealized gains, end top-down pressure that overrides local control, and restore a fair, predictable system that the people can trust.

👉 Act now: https://act4mo.info/ss-for-property-tax-reform.html